What Every Homebuyer Needs to Know Right Now

Introduction

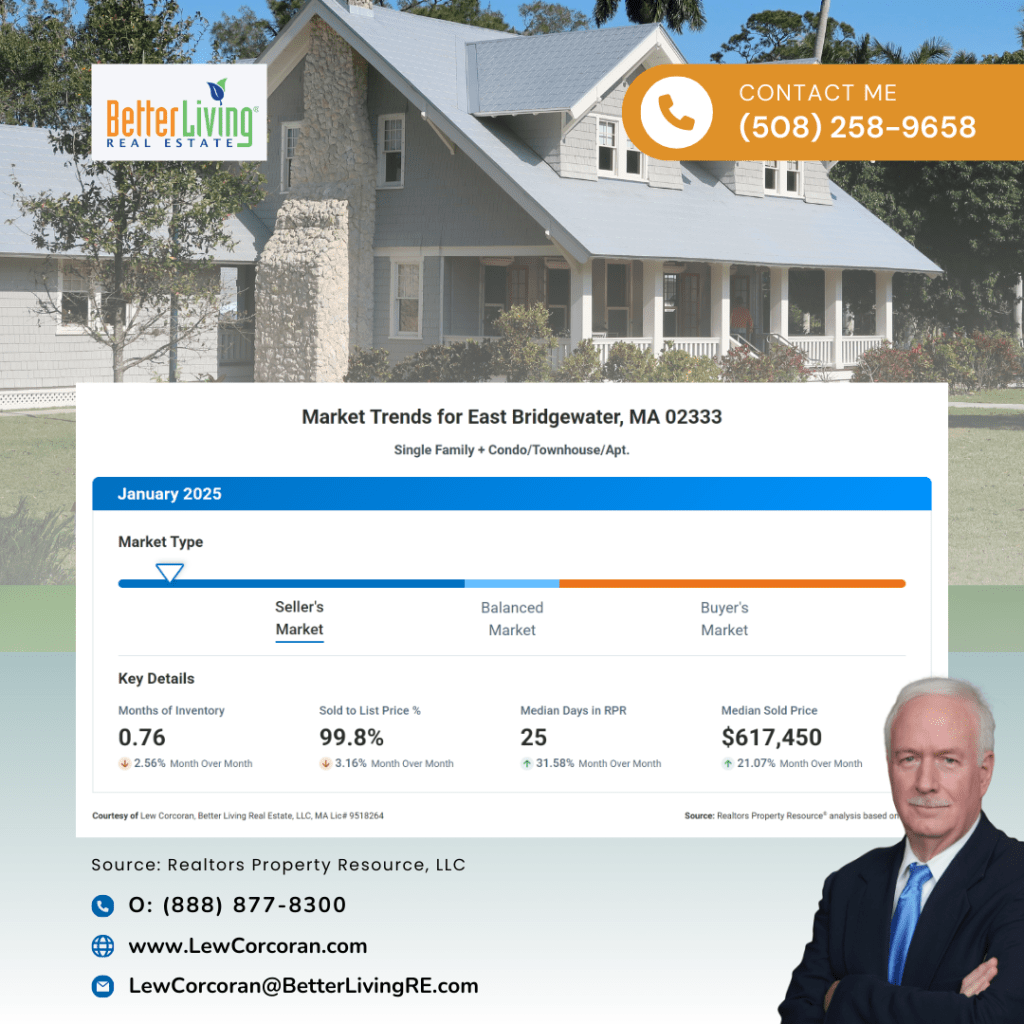

Thinking about buying a home in East Bridgewater, MA? You’re in for a ride! The market here is really buzzing, and understanding what’s happening can give you the upper hand. So, let’s break down the numbers in a way that makes sense for you.

The Low Supply Dilemma

First up is the Months Supply of Inventory, currently sitting at a jaw-dropping 0.76. What does that mean for you? Simply put, it means that if no new homes are listed, then all the current ones would disappear in less than a month. With such low inventory, it’s clear that buyers are facing a seller’s market. Homes are hot commodities here!

The Speed of Sales

Now let’s talk about the 12-Month Change in Months of Inventory. This baby is down by 41.54%. That’s a huge drop! Essentially, homes are selling way faster than they used to. If you spot a house you like, don’t wait too long—chances are, someone else has their eye on it too.

Don’t Blink: Homes Go Fast!

Speaking of speed, the Median Days Homes are On the Market is just 25 days. That’s hardly enough time to grab a coffee and make a decision! Homes are flipping off the market quicker than ever, confirming that demand is outpacing supply. You’ve got to be ready to jump in.

Strong Offers Are Key

Another important metric is the Sold to List Price Percentage, which stands at 99.8%. This number indicates that homes are selling for almost exactly what they were listed for. In a competitive market like this, solid offers matter. Showing that you’re serious can make all the difference.

Pricing Trends You Should Know

Lastly, let’s touch on the Median Sold Price, which is $617,450. This price point is pivotal for you as it reflects the market’s overall health. As prices climb, understanding where you fit in can help you make informed decisions.

Conclusion: Ready, Set, Go!

Overall, East Bridgewater’s real estate market is competitive. With fast sales and strong demand, being proactive is essential. So, if you find a home you love, go ahead and make that offer! Don’t let your dream home slip away.

Want to explore what East Bridgewater has to offer? Reach out today to start your search. Your perfect home might just be a click away!

Market Analysis Report

Want to stay ahead of the market in East Bridgewater? Get the latest insights on active listings, sold prices and market shifts—delivered straight to your inbox! Download your free market analysis report now!

My Service Area

My real estate agency services are tailored towards home buyers and sellers in Bristol and Plymouth counties in Southeastern Massachusetts.

Streamlining Your Home Buying Journey for a Satisfying Experience!

When it’s time to search for your ideal home, I’m dedicated to assisting you in reaching your goals and securing the best value for your investment.