Understanding the Current Trends for Homebuyers

Introduction

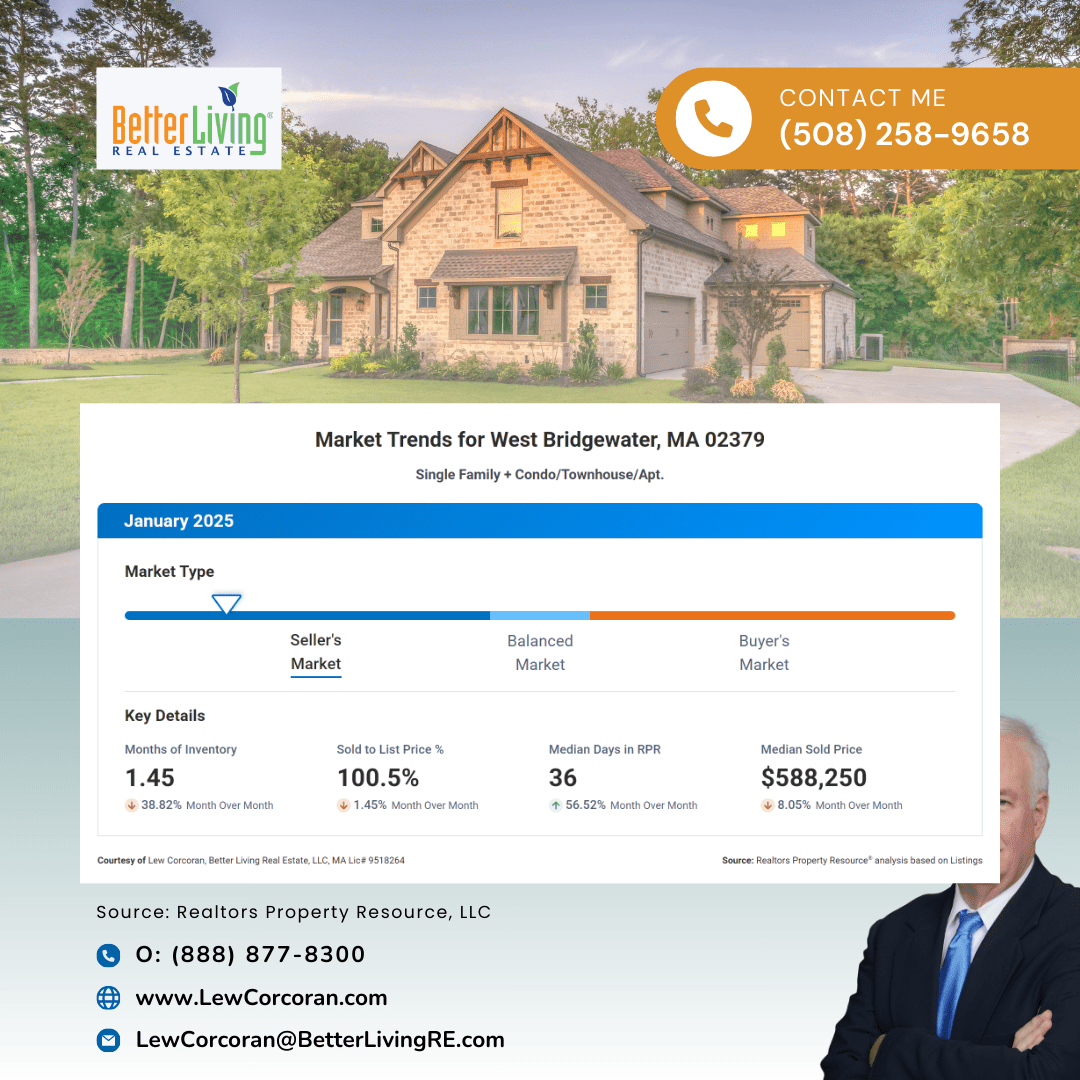

Are you thinking about buying a home in West Bridgewater? You’re in the right place! The market has been moving quickly, and understanding its trends can make all the difference in your home-buying journey.

What’s Going On in Inventory?

First off, the Months Supply of Inventory currently sits at 1.45. This number indicates how long it would take to sell all the homes if no new ones hit the market. A figure under two suggests it’s a seller’s market, meaning demand is high, and prices could be climbing.

A Quick Shift in the Numbers

Now, let’s talk about the change in Months of Inventory. It’s down a staggering 46.3% compared to last year. This decline means homes are selling faster than they have in the past, giving you less time to think about that perfect house. If you see something you love, don’t hesitate!

Speedy Sales Matter

Next, consider the Median Days Homes are On the Market, which is 36. This shorter timeline suggests homes are being snatched up quickly. If you find a property that feels right, be prepared to act fast.

Competing in the Market

Along the same lines, the Sold to List Price Percentage is currently at 100.5%. This means homes are selling for slightly above their list price. You might need to be ready to put in an attractive offer if you want to secure your dream home.

Understanding Price Points

Lastly, the Median Sold Price is $588,250. This figure reflects the average cost of homes in the area. It’s important to remember that there are properties available both above and below this price range, so keep your options open.

Conclusion and Your Next Steps

In summary, West Bridgewater’s real estate market is competitive and fast-paced. With limited inventory, you should be ready to move quickly when you find a place you like. Consider preparing your finances and doing research on home features that matter to you.

Time to Take Action!

If you’re interested in exploring your options, let’s connect. Reach out to discuss your home-buying strategy today! Having a trusted guide can make navigating this market a lot easier!

Market Analysis Report

Want to stay ahead of the market in West Bridgewater? Get the latest insights on active listings, sold prices and market shifts—delivered straight to your inbox! Get your free market analysis report now!

My Service Area

My real estate agency services are tailored towards home buyers and sellers in Bristol and Plymouth counties in Southeastern Massachusetts.

Streamlining Your Home Buying Journey for a Satisfying Experience!

When it’s time to search for your ideal home, I’m dedicated to assisting you in reaching your goals and securing the best value for your investment.