Unlocking the Secrets of a Competitive Market

Introduction

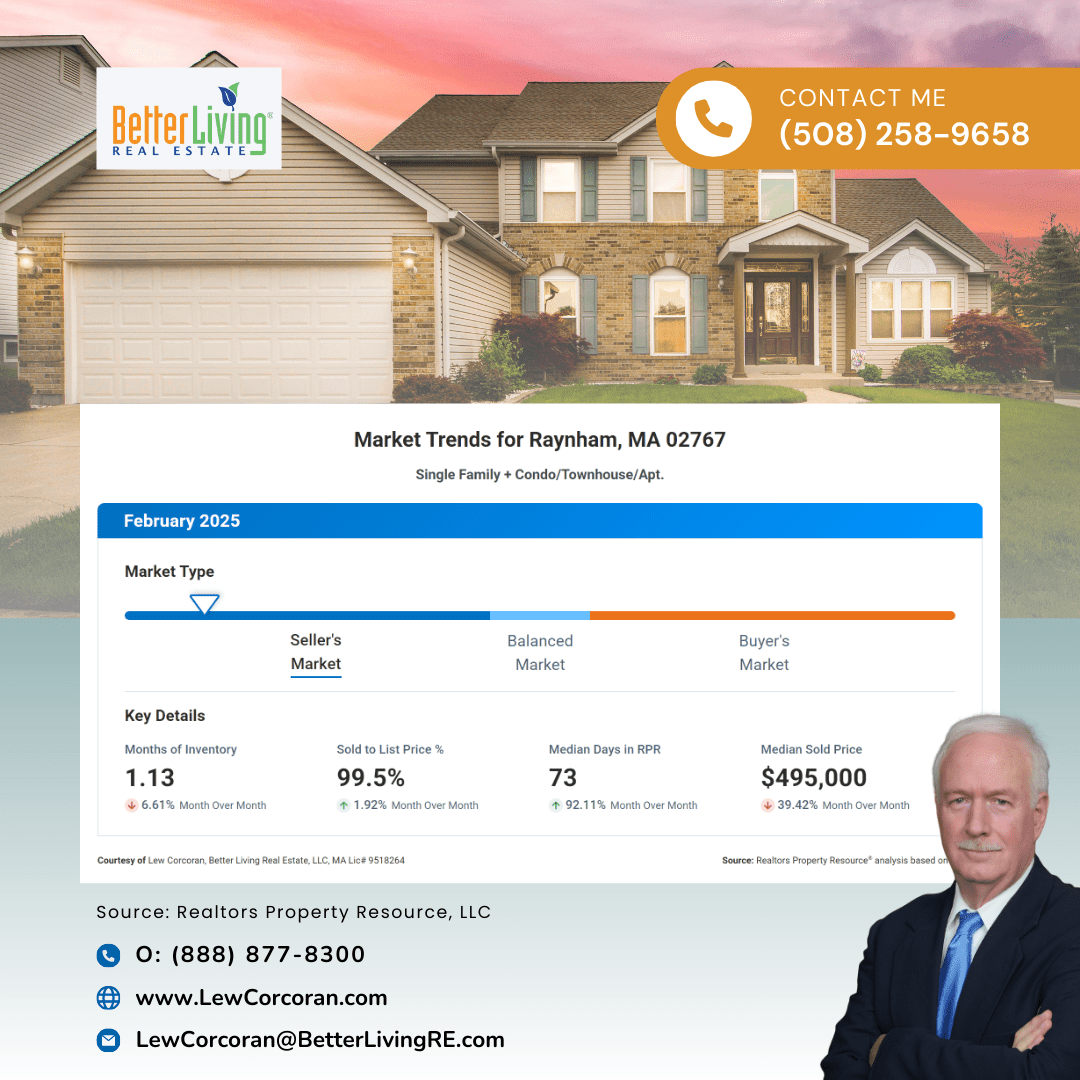

Are you looking to buy a home in Raynham, Massachusetts? If so, you’ve come to the right place! Understanding the current market trends is crucial to making informed decisions. As you navigate this competitive landscape, it’s essential to grasp the key metrics that shape your buying experience.

Market Inventory: What It Means for You

Let’s first discuss the Months Supply of Inventory, which sits at just 1.13. This number hints at a tight market where available homes are flying off the shelves. When inventory is low, it means you’ll face stiff competition from other eager buyers. Are you ready to put your best foot forward?

A Year of Change: Sales Dynamics

Now, consider the 12-Month Change in Months of Inventory at a steep decline of 60.21%. This significant decline suggests the market has accelerated in the past year. Homes are selling faster than ever, which means you might need to be prepared to act quickly and decisively if you want to snag your dream home.

Speed of Sales: The Clock is Ticking

The Median Days Homes are On the Market stands at 73. If you see a home that fits your needs, don’t hesitate! This metric shows that homes are moving swiftly, and a quick decision could be the difference between getting the keys or watching someone else swoop in.

Competitive Offers: Be Ready to Engage

High demand is further illustrated by the Sold to List Price Percentage, which is at a striking 99.5%. Buyers should expect to offer close to the asking price, often more. It’s best to come prepared with a strong offer to catch sellers’ attention.

Understanding Your Budget

Lastly, the Median Sold Price is currently $495,000. Knowing this average gives you a realistic expectation of what you might need to invest. Crunch those numbers and ensure your finances align with your dream home in Raynham.

Conclusion: Seize the Opportunity!

In summary, Raynham’s real estate market is buzzing with activity and challenges. With limited inventory, fast sales, and rising prices, you’ll need to stay alert and agile. Are you ready to find your ideal home in this vibrant community? Let’s work together to make it happen!

If you’re ready to dive into the Raynham market or have any questions, feel free to reach out. Knowledge is power, and your dream home might just be a conversation away!

Market Analysis Report

Want to stay ahead of the market in Raynham? Get the latest insights on active listings, sold prices, and market shifts—delivered straight to your inbox! Get your free market analysis report today!

My Service Area

My real estate agency services are tailored towards home buyers and sellers in Bristol and Plymouth counties in Southeastern Massachusetts.

Streamlining Your Home Buying Journey for a Satisfying Experience!

When it’s time to search for your ideal home, I’m dedicated to assisting you in reaching your goals and securing the best value for your investment.