Stay Ahead in a Competitive Market in Bridgewater MA

Introduction

Thinking about buying a home in Bridgewater? The market is moving quickly, and understanding the current trends can help you make smarter decisions. If you’re wondering what’s happening right now, this guide will break down the latest data and what it means for your home search. Let’s dive in!

Market Tightness and Limited Inventory

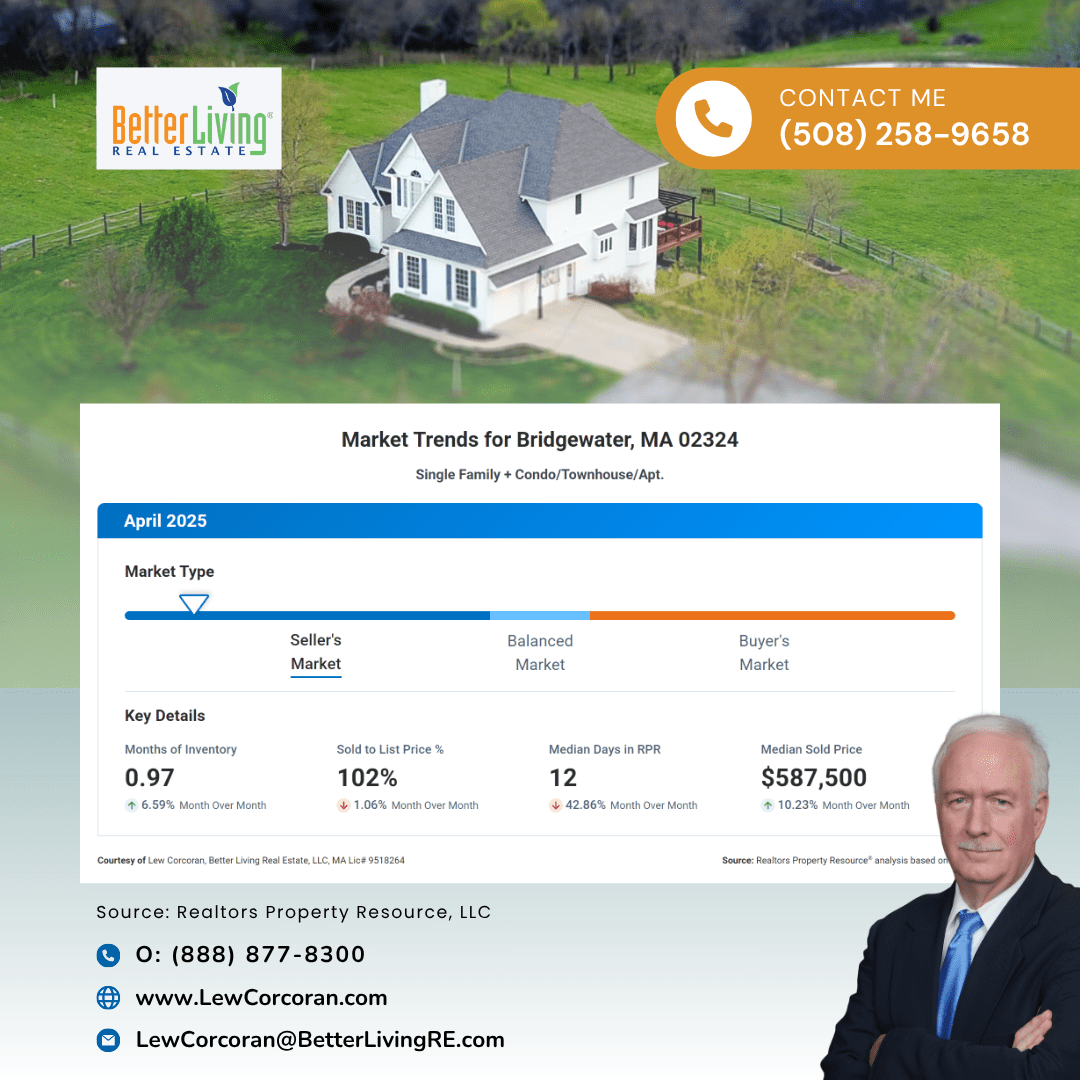

Right now, the Months Supply of Inventory sits at just 0.97. This means that if no new homes hit the market, everything available would sell out in less than a month. It’s a clear sign of a seller’s market, with high demand and not enough homes to go around.

Adding to this, the 12-Month Change in Inventory shows a drop of over 51%. This indicates fewer homes are available compared to last year, making the competition even fiercer for buyers. So, if you’re serious about finding the right home, being ready to act fast is essential.

Homes Are Selling Quickly

In fact, the median days on the market is just 12 days. That’s less than two weeks! Homes are moving fast, and waiting too long could mean missing out. Being prepared with your financing and a clear idea of what you want will give you a big advantage.

Prices Are Moving Beyond Asking

The Sold to List Price percentage is at 102%. On average, homes are selling for slightly above their list price. This highlights how competitive the market is—buyers are willing to pay more to secure the right property. If you find a home you love, don’t be surprised if you need to act quickly and possibly go above asking.

What Does This Mean for You?

Finally, the median sold price is $587,500. While this might seem high, it’s important to remember that properties are selling fast and often above asking. To succeed, you need to stay informed, work with a knowledgeable agent, and act decisively when the right home appears.

Conclusion

In summary, the Bridgewater market is fast-paced and competitive. Limited inventory and high demand mean you need to be prepared and proactive. Ready to start your home search? Reach out today, and let’s find the perfect home for you before someone else does!

Market Analysis Report

Want to stay ahead of the market in Bridgewater? Get the latest insights on active listings, sold prices, and market shifts—delivered straight to your inbox! Get your free market analysis report today!

My Service Area

My real estate agency services are tailored towards home buyers and sellers in Bristol and Plymouth counties in Southeastern Massachusetts.

Streamlining Your Home Buying Journey for a Satisfying Experience!

When it’s time to search for your ideal home, I’m dedicated to assisting you in reaching your goals and securing the best value for your investment.